Objective:

The U.S. Federal Reserve cut interest rates by 25bps on October 29, 2025, bringing the target range to 3.75–4.00%. Explore why the Fed acted, Jerome Powell’s key remarks, and how this decision affects inflation, gold prices, and global markets.

Outlook:

The U.S. Federal Reserve announced a 25 basis point rate cut on October 29, 2025, lowering the federal funds rate to 3.75%–4.00%. This marks the second consecutive rate cut in 2025, as the central bank aims to cushion the economy from slowing growth and rising unemployment concerns.

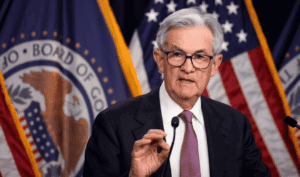

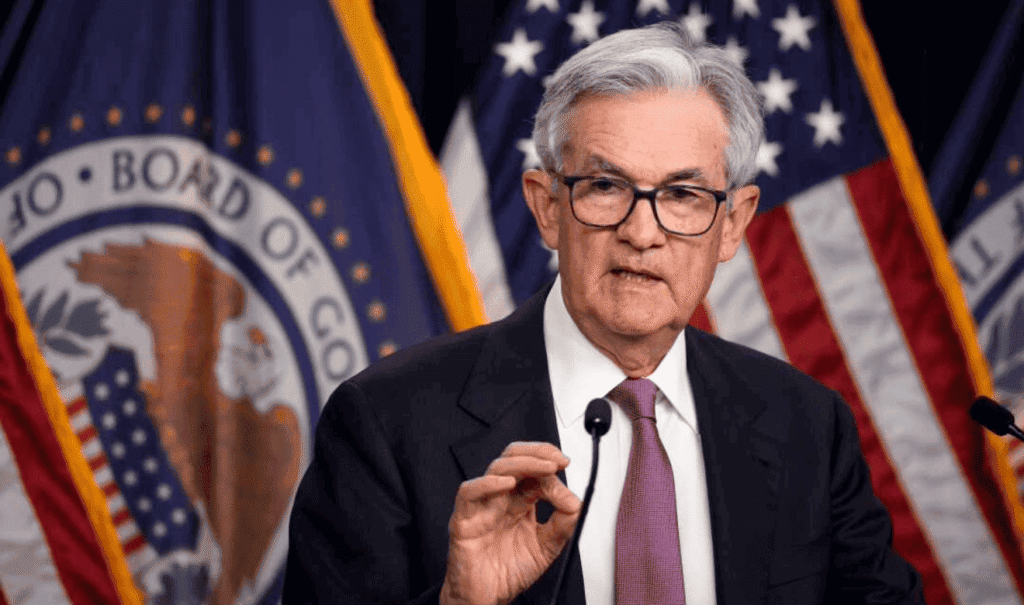

Fed Chair Jerome Powell emphasized that while inflation remains above target, the balance of risks has shifted toward weaker economic momentum.

Read Chair Powell's full opening statement from the #FOMC press conference (PDF): https://t.co/5b0sO4wUxc pic.twitter.com/AnIGRVRXHV

— Federal Reserve (@federalreserve) October 29, 2025

Why Did the Fed Cut Rates Again in October 2025?

The FOMC’s decision stems from a combination of slower job growth, moderating inflation, and limited data visibility due to the ongoing U.S. government shutdown.

1. Slowing Economic Growth

Recent data points to cooling consumer spending and reduced business investments. Job growth slowed notably in Q3 2025, with unemployment edging up to 4.3%.

2. Inflation Moderation

Headline inflation eased to around 3% YoY, down from 3.4% earlier this year. Although still above the Fed’s 2% target, the decline provided space for policy easing.

3. Policy Uncertainty Due to Shutdown

The federal government shutdown has hindered the release of several key economic reports, forcing the Fed to operate in what Powell called a “data fog.”

Highlights from the FOMC Statement

- Rate Decision: Cut by 25bps to 3.75–4.00%

- Vote Split: Two dissenting members favored holding rates steady

- Policy Outlook: Future moves will be data-dependent, with no commitment to further cuts

- Inflation Goal: Maintain progress toward 2% without risking a deep slowdown

Federal Reserve issues #FOMC statement: https://t.co/PN2waoTZrP

— Federal Reserve (@federalreserve) October 29, 2025

What This Means for Borrowers and Consumers

Lower policy rates can lead to:

Cheaper borrowing for mortgages, auto loans, and business credit lines

Potentially higher equity and bond valuations

Short-term boost in consumer sentiment

However, banks may take weeks to pass on lower rates, and lending standards remain tight.

Global Impact and Implications for India

Global Markets

The rate cut provides a relief rally across global markets. Lower U.S. yields ease funding costs worldwide, improving risk appetite.

For India

- Strengthens the Indian rupee against the dollar

- Encourages foreign portfolio inflows into Indian equities and bonds

- Helps stabilize oil import bills and reduce inflationary pressure

Indian investors may see short-term gains in equities and gold as global liquidity improves.

Expert Opinions on the Fed’s October 2025 Move

“This rate cut is a measured adjustment, not the start of a rate-cut cycle,” said a Reuters analyst.

“The Fed wants to prevent a hard landing while keeping inflation expectations anchored.”

Financial strategists believe the next policy move will depend heavily on November inflation data and labor reports once the shutdown ends.

What to Watch Ahead

- Inflation Reports (Nov–Dec 2025) – Will CPI continue to cool?

- Labor Market Trends – Any signs of layoffs or job recovery?

- Fed’s December Meeting – Markets currently price in a 40% chance of another 25bps cut.

- Global Growth Trends – Especially from China and Eurozone economies.

Conclusion: A Cautious Yet Supportive Fed

The Fed’s October 29, 2025 rate cut reflects a strategic pivot toward supporting growth without fully abandoning its inflation fight.

While the move offers short-term relief for borrowers and markets, it also signals that the Fed is not on an aggressive easing path.

For global markets—including India—the decision is a positive shift toward monetary flexibility amid uncertain economic data.

FAQs: Fed Rate Cut October 2025

1. What is the new U.S. interest rate after the Fed’s October 2025 meeting?

The new federal funds rate is 3.75%–4.00%, following a 25bps cut.

2. Why did the Fed reduce rates?

To address a slowing economy, cooling job growth, and easing inflation pressures.

3. Will mortgage and loan rates drop soon?

Yes, gradually—commercial banks typically adjust lending rates over the next few weeks.

4. How does this affect India and emerging markets?

It supports capital inflows, strengthens local currencies, and eases inflationary risks.

5. When is the next Fed meeting?

The next FOMC meeting is scheduled for December 17–18, 2025, where the Fed will reassess growth and inflation trends.

Search

Latest News

Market Forecast

Expert Elliott Wave Analysis

We Help to identifies impulsive and corrective phases, helping traders predict price movements. By recognizing these natural market cycles, traders can identify trends, reversals, and ideal entry points, improving their trading precision and overall decision-making across different financial markets.