Major Key Points to Consider

- Primary Scenario (Bearish) : Consider short positions from corrections below the level of 54.5 with a target of 45 – 42. A sell signal: the price holds below 48. Stop Loss: above 53, Take Profit: 45 – 42.

- Alternative Scenario (Bullish): Breakout and consolidation above the level of 54.50 will allow the pair to continue rising to the levels of 60.5 – 62.55. A buy signal: the level of 54.5 is broken to the upside. Stop Loss: below 54, Take Profit: 60.5 – 62.55.

Technical Indicators

Trend: Short-term Bullish within a long-term Downtrend.

Support Levels: 46.5 – 48

Resistance Levels: 51 – 53..5

Momentum: Neutral to Bearish on daily timeframe

Elliott Wave Analysis

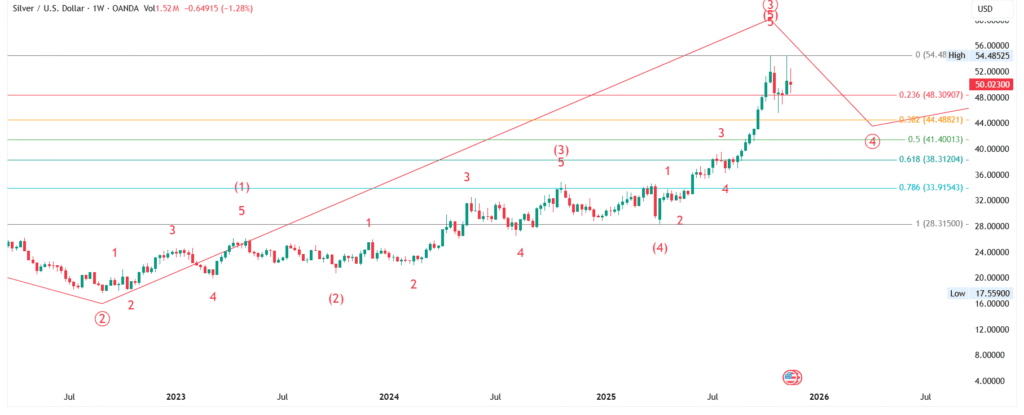

On A Weekly Chart : A Rising Larger Wave of Degree 5 is developing on the weekly chart of Silver : XAG/USD. Within this Larger Wave of Degree 5, the smaller wave of degree 4 Seems to be completed as wave ((3)) developing from year 2023. Now the price is Moving in Wave ((4)) .

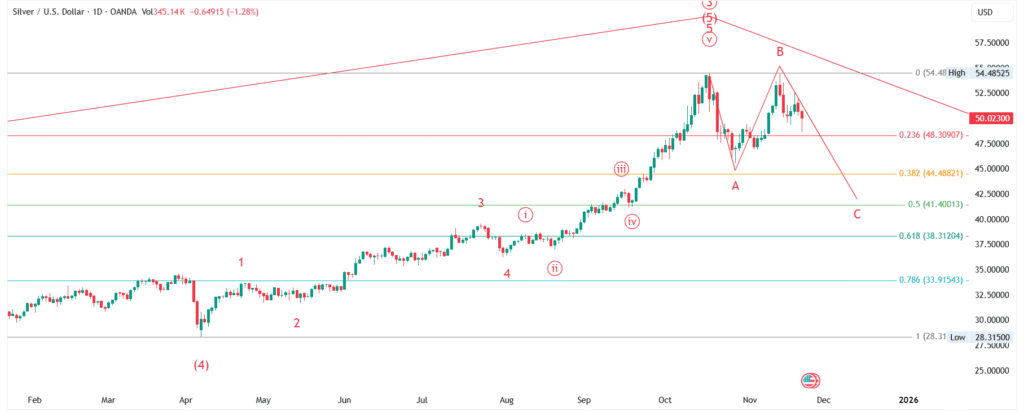

On A Daily Chart : Within the Correction wave ((4)), The Correction leg A & B has been formed and Price is moving in Correction Leg C of large ZIG-ZAG structure.

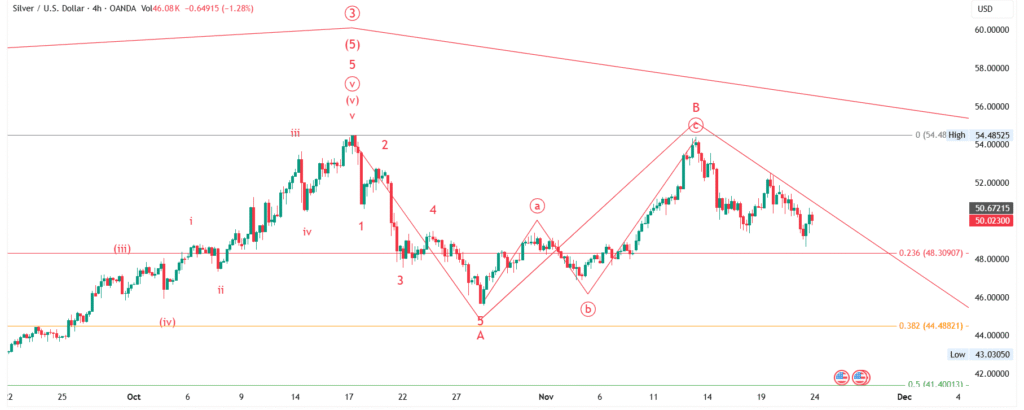

On A 4-Hours Chart : The Wave C of large large ZIG-ZAG is unfolding and price movement is not so developed. Traders must wait and watch the the further development.

If this Presumption is correct then Silver: XAG/USD may continue to Decline to the Price levels of 45 – 42.

XAG/USD : Silver Current Rate in the Market

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of Webmile | Markets [A propriety of SingleDot Technologies]. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice. According to copyright law, this article is considered intellectual property, which includes a prohibition on copying and distributing it without consent.

This forecast is based on the Elliott Wave Theory. When developing trading strategies, it is essential to consider fundamental factors, as the market situation can change at any time.

Expert Elliott Wave Analysis

We Help to identifies impulsive and corrective phases, helping traders predict price movements. By recognizing these natural market cycles, traders can identify trends, reversals, and ideal entry points, improving their trading precision and overall decision-making across different financial markets.